1.In 1992, which organisation launched Self Help Group – Bank Linkage Programme?

A. SEBI

B. NABARD

C. SBI

D. RBI

Solution

The correct answer is NABARD.

Key Points

- NABARD (National Bank for Agriculture and Rural Development) launched the Self Help Group – Bank Linkage Programme (SHG-BLP) in 1992, which is considered the world’s largest microfinance initiative.

- The programme aims to link banks and Self Help Groups (SHGs), enabling financial inclusion and empowering rural households, especially women.

- SHGs under this programme pool savings from members and use these funds for internal lending. Once they demonstrate financial discipline, they are eligible for loans from banks.

- By March 2022, over 10 million SHGs were linked to banks under this programme, benefiting around 100 million rural households.

- The initiative focuses on fostering sustainable livelihoods and improving socio-economic conditions in rural areas.

Additional Information

- Self Help Groups (SHGs):

- SHGs are informal associations of 10-20 people, typically women, who come together to save small amounts and access credit to meet their needs.

- The concept of SHGs promotes financial literacy, peer support, and collective decision-making.

- Objectives of SHG-Bank Linkage Programme:

- The programme strives to improve access to formal financial services for rural poor.

- It aims to promote self-employment and entrepreneurship among rural households.

- NABARD:

- NABARD was established in 1982 under the recommendations of the B. Sivaraman Committee.

- It is India’s apex development bank for financing agriculture and rural development.

- NABARD plays a pivotal role in rural credit planning and implementation of various government schemes.

- Microfinance:

- Microfinance refers to providing small loans and financial services to individuals or groups who lack access to traditional banking services.

- It is a critical tool for promoting financial inclusion and alleviating poverty.

2. The minimum requirement of microfinance loans for NBFC-MFls is _______

A. 75% of the total assets

B. 75% of the total equity

C. 90% of the total assets

D. 80% of the total equity

Solution

The correct answer is 75% of the total assets.

Key Points

- NBFC-MFIs:-

- Non-Banking Financial Company-Micro Finance Institutions, are a type of non-banking financial institution in India.

- They are specifically designed to provide microfinance services, which typically target low-income individuals or groups who do not have access to traditional banking and financial services.

- Generally, NBFCs in India are regulated by the Reserve Bank of India (RBI), but NBFC-MFIs answer to a more specific set of regulations due to their unique business model.

- This is because they often deal with vulnerable sections of society, which necessitates particular safeguards.

- Microloans provided by MFIs are intended to help individuals start or expand their small businesses. Thus, they play an important role in poverty reduction and financial inclusion.

- The minimum requirement of microfinance loans for NBFC-MFls is 75% of the total assets.

3. A market consisting of more than one (but few) sellers is called as

A. Isoquant

B.Monopoly

C. Oligopoly

D. None of the above

Solution

The correct answer is Oligopoly.

Key Points

- An oligopoly is a market structure characterized by a small number of firms whose decisions about production and pricing significantly affect one another.

- Firms in an oligopoly are interdependent, meaning that the actions of one firm will impact the others.

- Oligopolies can lead to collusive behaviors, where firms agree to set prices or output levels to maximize joint profits.

- Due to the limited competition, oligopolies can result in higher prices and reduced output compared to more competitive markets.

Additional Information

- Monopoly:

- A market structure where a single firm controls the entire market.

- The firm is the sole producer and can set prices without competition.

- Monopolies can lead to higher prices and less innovation.

- Perfect Competition:

- A market structure characterized by a large number of small firms, homogeneous products, and free entry and exit.

- Firms are price takers due to the large number of competitors.

- Perfect competition leads to optimal resource allocation and economic efficiency.

- Monopolistic Competition:

- A market structure with many firms selling differentiated products.

- Firms have some control over pricing due to product differentiation.

- Monopolistic competition can lead to innovation and variety but may also result in inefficiencies.

- Duopoly:

- A specific type of oligopoly with only two firms dominating the market.

- Duopolistic firms may engage in competitive or collusive behaviors.

- Market outcomes can vary significantly based on the strategic decisions of the two firms.

4. _________ refers to buying and selling of bonds issued by the Government.

A. Marginal requirement

B. Closed Market Operations

C. Moral suasion

D. Open Market Operations

Solution

The correct answer is Open Market Operations.

Key Points

- Open Market Operations (OMO) are the actions taken by a central bank to buy or sell government bonds in the open market.

- This process is used to regulate the money supply and influence interest rates in the economy.

- When the central bank buys bonds, it increases the money supply, making it easier for banks to lend money and potentially lowering interest rates.

- Conversely, when it sells bonds, it decreases the money supply, which can lead to higher interest rates.

- OMOs are a primary tool for monetary policy and are critical in managing economic stability.

Additional Information

- Marginal Requirement:

- Marginal requirement refers to the minimum percentage of deposits that banks are required to keep as reserves.

- It is not directly related to the buying or selling of government bonds.

- This requirement is set by the central bank and is aimed at ensuring that banks maintain liquidity.

- Changes in marginal requirements can affect the money supply and lending capacity of banks.

- Closed Market Operations:

- Closed Market Operations are not a standard term in monetary policy and typically refer to scenarios where a central bank does not engage in buying or selling government securities.

- It can also imply a market where there are restrictions on the buying and selling of government bonds.

- This term is less commonly used compared to open market operations.

- Moral Suasion:

- Moral suasion is a non-coercive method used by central banks to persuade banks and financial institutions to adhere to certain policies.

- It involves communication and appeals rather than direct action, such as buying or selling bonds.

- While it can influence monetary policy, it does not involve the actual trading of government bonds in the market.

- This approach relies on the credibility of the central bank to guide the financial behavior of institutions.

5. The Interim Budget, 2024-25, announced a strategy to achieve ‘Atmanirbharta’ (self-reliance) in the production of which of the following oilseeds?

A. Cotton, jute, sugarcane and tea

B. Mustard, groundnut, sesame, soybean and sunflower

C. Rice, wheat, maize and pulses

D. Barley, sorghum, bajra and ragi

Solution

The correct answer is Mustard, groundnut, sesame, soybean, and sunflower.

Key Points

- The Interim Budget 2024-25 emphasized achieving self-reliance (Atmanirbharta) in oilseed production to reduce dependency on imports.

- The targeted oilseeds include mustard, groundnut, sesame, soybean, and sunflower, which are vital for India’s edible oil requirements.

- India is one of the largest consumers of edible oils globally but heavily relies on imports, especially palm oil from countries like Indonesia and Malaysia.

- Promoting domestic production of these oilseeds aligns with the government’s vision of sustainable agriculture and reducing the import bill.

- The initiative includes measures such as financial assistance to farmers, improved seed distribution, and technology adoption to enhance yield and production.

Additional Information

- Edible Oil Scenario in India:

- India consumes approximately 22-25 million tonnes of edible oils annually, with a significant portion being imported.

- Major imported edible oils include palm oil, soy oil, and sunflower oil.

- The dependency on imports poses challenges related to price fluctuations and trade policies.

- National Mission on Edible Oils-Oil Palm (NMEO-OP):

- Launched in 2021, this mission aims to boost domestic production of edible oils, particularly palm oil.

- It includes financial support for farmers, subsidies, and research to develop high-yielding oilseed crops.

- The mission has a budgetary allocation of Rs. 11,040 crore over five years.

- Importance of Oilseeds in Agriculture:

- Oilseeds are a rich source of edible oils and protein-rich byproducts used in animal feed.

- They contribute significantly to sustainable farming practices and soil health.

- Promoting oilseed cultivation helps diversify cropping patterns and enhances farmers’ income.

- Government Support for Oilseed Farmers:

- The Minimum Support Price (MSP) is declared annually for oilseeds to ensure fair prices for farmers.

- Subsidies are provided for high-quality seeds, irrigation, and fertilizers.

- Training programs are conducted to educate farmers on advanced cultivation techniques.

6. In which year was the Fiscal Responsibility and Budget Management (FRBM) Act enacted?

A. 2018

B. 2013

C. 2003

D. 2008

Solution

The correct answer is 2003.

Key Points

- The Fiscal Responsibility and Budget Management (FRBM) Act was enacted in 2003 by the Government of India.

- The FRBM Act was aimed at introducing financial discipline and reducing India’s fiscal deficit.

- It set targets for the government to reduce fiscal deficit and revenue deficit over a period of time.

- The legislation mandated the government to achieve a fiscal deficit of 3% of GDP and eliminate revenue deficit by March 2008.

- The Act was implemented under the leadership of then Finance Minister Jaswant Singh.

Additional Information

- Key Objectives of FRBM Act:

- To ensure intergenerational equity in fiscal management.

- To improve the transparency and accountability in India’s fiscal operations.

- To eliminate revenue deficit and reduce fiscal deficit.

- Amendments to FRBM Act:

- In 2018, the FRBM Act was amended to replace revenue deficit targets with effective revenue deficit targets.

- The amendment introduced a new medium-term fiscal framework.

- It aimed to align fiscal policy with long-term economic goals.

- Challenges in Implementation:

- Economic slowdown and external shocks have made achieving fiscal targets difficult.

- High subsidies and expenditure on social welfare schemes pose challenges to fiscal consolidation.

- Related Terminology:

- Fiscal Deficit: The difference between total revenue and total expenditure of the government, excluding borrowing.

- Revenue Deficit: The shortfall in government’s current income compared to its current expenses.

- Primary Deficit: Fiscal deficit minus interest payments.

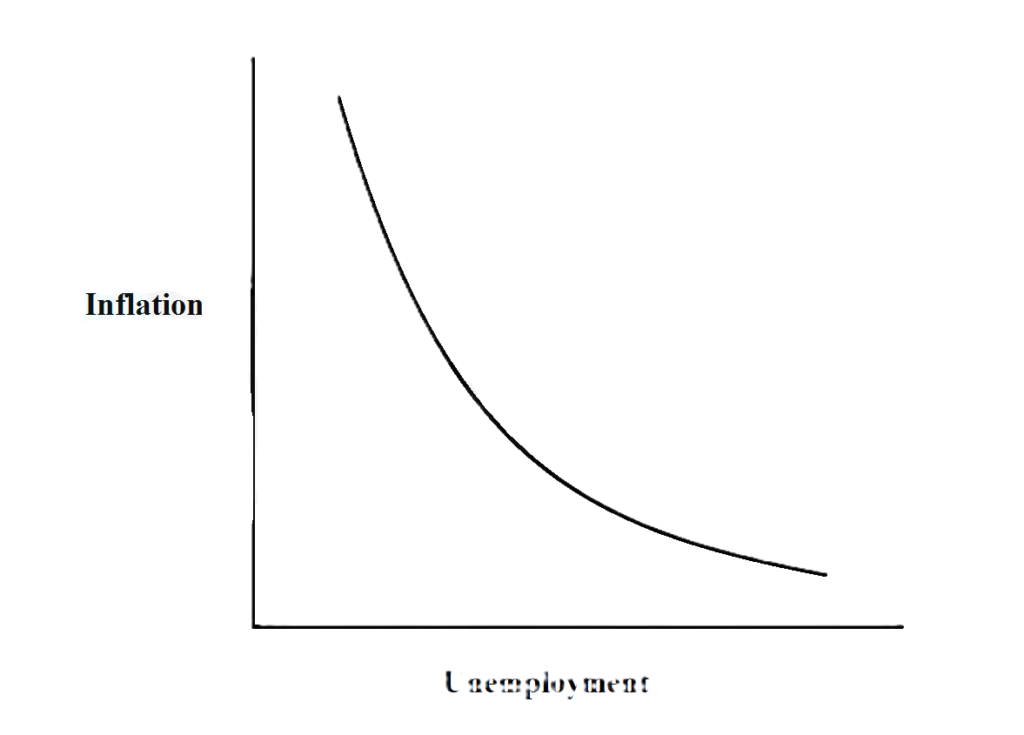

7. Which of the following curves shows a relationship between inflation and unemployment?

A. Philips curve

B. Kuznets curve

C. Laffer curve

D. Lorenze curve

Solution

The correct answer is Philips curve.

Key Points

- Philips curve –

- The Phillips curve is an economic concept developed by A. W Phillips

- Stating that inflation and unemployment have a stable and inverse relationship. Hence statement 1 is correct.

- The theory claims that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment.

Philips Curve

Important Points

- Kuznets curve – It shows the relationship between economic growth and inequality. It shows that initially economic growth leads to greater inequality, followed later by the reduction of inequality.

- Laffer curve – It shows the relationship between tax rates and the amount of tax revenue collected by governments.

- Lorenze curve – It is a representation of income inequality or wealth inequality developed by American economist Max Lorenz in 1905.

8. Unemployment arising due to mismatch between Job availability in the market and skills of available worker is called?

A. Seasonal

B. Structural

C. Economical

D. Frictional

Solution

The correct option is Structural.

Key Points

- The term unemployment refers to a situation where a person actively searches for employment but is unable to find work.

- Structural unemployment comes about through a technological change in the structure of the economy in which labour markets operate.

- Technological changes can lead to unemployment among workers displaced from jobs that are no longer needed

- Examples of such changes include the replacement of horse-drawn transport with automobiles and the automation of manufacturing,

Additional Information

- Frictional Unemployment

- This type of unemployment is usually short-lived. It is also the least problematic from an economic standpoint. It occurs when people voluntarily change jobs.

- Seasonal unemployment

- It occurs at different points over the year because of seasonal patterns that affect jobs. Some examples include ski instructors, fruit pickers and holiday-related jobs.

- Economic Unemployment

- During an economic downturn, a shortfall of demand for goods and services results in a lack of jobs available for those who want to work. Businesses experiencing weaker demand might reduce the number of people they employ by laying off existing workers or hiring fewer new workers.

9. Fiscal Deficit is

A. Budget expenditure – Budget receipts excluding borrowings

B. Equal to Primary Deficit

C. Capital expenditure – Capital receipts

D. Revenue expenditure – Revenue receipts

Solution

The correct answer is Budget expenditure- Budget receipts excluding borrowings.

Key Points

- Fiscal Deficit is the difference between the total income of the government (total taxes and non-debt capital receipts) and its total expenditure. While calculating the total revenue, borrowings are not included. Hence, Fiscal Deficit is- Budget expenditure- Budget receipts excluding borrowings.

- A fiscal deficit situation occurs when the government’s expenditure exceeds its income. This difference is calculated both in absolute terms and also as a percentage of the Gross Domestic Product (GDP) of the country. A recurring high fiscal deficit means that the government has been spending beyond its means.

- The government describes fiscal deficit of India as “the excess of total disbursements from the Consolidated Fund of India, excluding repayment of the debt, over total receipts into the Fund (excluding the debt receipts) during a financial year”.

Important Points

- What constitutes the government’s total income or receipts?

- It has two components revenue receipts and non-tax revenues.

- Revenue receipts of the government

- Corporation Tax

- Income Tax

- Custom Duties

- Union Excise Duties

- GST and taxes of Union territories.

- Non-tax revenues

- Interest Receipts

- Dividends and Profits

- External Grants

- Other non-tax revenues

- Receipts of union territories

- Revenue receipts of the government

- It has two components revenue receipts and non-tax revenues.

- Expenditures of the government:

- Revenue Expenditure

- Capital Expenditure

- Interest Payments

- Grants-in-aid for creation of capital assets

Key Points

- Fiscal Deficit formula:

- Fiscal Deficit = Total expenditure of the government (capital and revenue expenditure) – Total income of the government (Revenue receipts + recovery of loans + other receipts)

- If the total expenditure of the government exceeds its total revenue and non-revenue receipts in a financial year, then that gap is the fiscal deficit for the financial year.

- The government meets fiscal deficit by borrowing money. In a way, the total borrowing requirements of the government in a financial year is equal to the fiscal deficit in that year.

10. Which among the following is an example of Indirect tax?

A. Income tax

B. Wealth tax

C. Sales tax

D. Corporate tax

Solution

The correct answer is Sales tax.

Key PointsIndirect Taxes –

- Indirect Tax is a tax imposed on an individual or entity which is passed on to other individuals.

- It is imposed on products or services which are used by the customer.

- Common examples of indirect taxes are GST, excise duties, sales tax, service tax, customs duty, VAT.

- Goods and Services Tax –

- The GST is an indirect tax that replaced many indirect taxes such as excise duty, Value added tax, and service taxes in India.

- The Goods and Services Act was passed in parliament on 29th March 2017 and came into effect on 1st July 2017.

Additional InformationDirect Taxes –

- The tax that is directly paid to the Government, is directly imposed on the taxpayer and the liability of tax cannot be passed on to other taxpayers.

- Some of examples of Direct taxes are Income-tax, Corporate tax, Minimum Alternate Tax, Dividend Distribution Tax, Securities Transaction Tax, Capital gains Tax .etc.

Important point

- The gift tax was a type of Direct tax which was abolished in 1998.