1. What does a price ceiling above the equilibrium price result in?

A. A surplus of goods

B. No impact on the market

C. A shortage of goods

D. Equilibrium in the market

Solution

The correct answer is No impact on the market.

Key Points

- A price ceiling is a government-imposed limit on the price charged for a product, essentially setting a maximum allowable price.

- When a price ceiling is set above the equilibrium price level, it has no immediate effect on the market as the market-determined price falls below the price ceiling.

- Sellers are already selling the product at a lower price than the price ceiling, and therefore, they continue to sell at this market-determined price.

Hence, the price ceiling in this scenario does not disrupt market forces.

2. Which of the, following statements is/are correct?

1. If the increase in demand and supply are of equal magnitude, the price will remain unchanged, but the equilibrium quantity will increase.

2. If the increase in demand is of greater magnitude than an increase in supply, both the equilibrium price and the equilibrium quantity will increase.

3. If the increase in supply is of greater magnitude than an increase in demand, equilibrium price will fall but equilibrium quantity will increase.

Select the correct answer using the code given below:

A. 1 only

B. 1 and 2 only

C. 2 and 3 only

D. 1, 2 and 3

Solution

The correct answer is 1, 2 and 3.

Key Points

- The law of supply and demand is a theory that explains the interaction between the supplier and the buyers for that resource.

- The theory defines the relationship between the price of a given good or product and the willingness of people to either buy or sell it.

- Generally, as price increases, people are willing to supply more and demand less and vice versa when the price falls.

- The equilibrium price is the price at which the producer can sell all the units he wants to produce and the buyer can buy all the units he wants.

- The Equilibrium quantity is when supply equals demand for a product.

Important Points

- THE EFFECTS OF CHANGES IN DEMAND AND SUPPLY ON EQUILIBRIUM PRICE AND QUANTITY:

- If demand and supply change in opposite directions, then the change in the equilibrium price can be determined, but the change in the equilibrium. output cannot.

- A decrease in demand and an increase in supply will cause a fall in equilibrium price, but the effect on equilibrium quantity cannot be determined.

- For any quantity, consumers now place a lower value on the good, and producers are willing to accept a lower price; therefore, the price will fall. The effect on output will depend on the relative size of the two changes.

- If demand and supply change in the same direction, the change in the equilibrium output can be determined, but the change in the equilibrium price cannot.

- If both demand and supply increase, there will be an increase in the equilibrium output, but the effect on price cannot be determined.

- If both demand and supply decrease, there will be a decrease in the equilibrium output, but the effect on price cannot be determined.

3. A good for which demand decreases with increase in income of consumer is called

A. Public good

B. Complementry good

C. Inferior good

D. Giffen good

Solution

The correct answer is Inferior good.

Key Points

- As the income of the consumer increases, the demand for an inferior good falls, and as the income decreases, the demand for an inferior good rises.

- Inferior goods include low-quality food items like coarse cereals.

- Inferior goods demand is inversely proportional to the income of consumers.

Additional Information

| Types of goods | Features | Example |

| Inferior goods | demand drop as consumers incomes rise | include low-quality food items like coarse cereals |

| Giffen goods | A Giffen good is a low income, non-luxury product for which demand increases as the price increases and vice versa.A Giffen good is typically an inferior product that does not have easily available substitutes, as a result of which the income effect dominates the substitution effect. | The cost of bread was rising as people lacked the income to buy meat during World War II was used as one of the earliest examples by Alfred Marshall to explain this concept. |

| Complementary Goods | Goods that are consumed together | tea and sugar, shoes and socks, pen and ink |

| Substitute Goods | Goods that are a substitute for each other | tea and coffee |

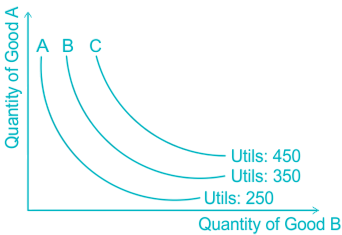

4. In consumer theory, which one is constant in the indifference curve?

A. Price

B. Demand

C. Supply

D. Utility

Solution

The correct answer is Utility.

Key Points

- Consumer theory is the study of how people decide to spend their money based on their individual preferences and budget constraints.

- Building a better understanding of individuals’ tastes and incomes is important because these factors impact the shape of the overall economy.

- Consumer theory is not flawless, though, as it is based on a number of assumptions about human behavior.

- An indifference curve is a contour line where utility remains constant across all points on the line. Each point on an indifference curve represents a consumption bundle, and the consumer is indifferent among all consumption bundles on the indifference curve.

5. Which of the following is correct regarding Opportunity Cost?

A. To properly evaluate opportunity costs, the costs and benefits of every option available must be considered and weighed against the others.

B. Opportunity cost analysis does not play a crucial role in determining a business’s capital structure.

C. Considering the value of opportunity costs can not guide individuals and organizations to more profitable decision making.

D. It is the benefit that is derived from an option that is chosen.

Solution

The correct answer is Option 1.

Key Points

- Opportunity Cost

- Opportunity costs represent the potential benefits that an individual, investor, or business misses out on when choosing one alternative over another.

- Because opportunity costs are unseen by definition, they can be easily overlooked.

- Understanding the potential missed opportunities when a business or individual chooses one investment over another allows for better decision-making.

- Opportunity cost is the forgone benefit that would have been derived from an option not chosen. Hence, Statement 4 is not correct.

- To properly evaluate opportunity costs, the costs and benefits of every option available must be considered and weighed against the others. Hence, Statement 1 is correct.

- Considering the value of opportunity costs can guide individuals and organizations to more profitable decision-making. Hence, Statement 3 is not correct.

- The formula for calculating an opportunity cost is simply the difference between the expected returns of each option.

- Opportunity cost analysis plays a crucial role in determining a business’s capital structure. Hence, Statement 2 is not correct.

- A firm incurs an expense in issuing both debt and equity capital to compensate lenders and shareholders for the risk of investment, yet each also carries an opportunity cost.

6. Who is known as the “Father of Modern Economics”?

A. Adam Smith

B. Marshal

C. Keynes

D. Robins

Solution

The correct answer is Adam Smith.

- Adam Smith is called the father of modern economics.

- Smith is well-known for writing The Wealth of Nations, a timeless book.

Key Points

- According to Adam Smith, ‘It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their interest,’

- Smith is also credited with inventing the idea of the gross domestic product (GDP) and his theory of how to compensate for wage disparities.

- This hypothesis holds that jobs that are risky or unappealing typically pay more to attract workers to these positions.

Hence, the correct answer is that Adam Smith is the father of modern economics.

7. Demand curve of a firm under perfect competition is

A. Perfectly elastic (Ed = ∞)

B. Perfectly inelastic (Ed = 0)

C. Relatively elastic (Ed > 1)

D. Relatively inelastic (Ed < 1)

Solution

Key Points

Under perfect competition, a demand curve of the firm is perfectly elastic because the firm can sell any amount of goods at the prevailing price. So even a small increase in price will lead to zero demand. This indicates that the firm has no control over price.

Perfect competition in an industry structure is when, there are many firms, none large enough to influence the industry, producing homogeneous products. Firms are price takers. There are no barriers to entry. Agriculture comes close to being perfectly competitive.

Perfect competition leads to the Pareto-efficient allocation of economic resources. Because of this, it serves as a natural benchmark against which to contrast other market structures. However, in practice, very few industries can be described as perfectly competitive.

A perfectly competitive market has several important characteristics:

- All producers contribute insignificantly to the market. Their own production levels do not change the supply curve.

- All producers are price takers. They cannot influence the market. If a firm tries to raise its price consumers would buy from a competitor with a lower price instead.

- Products are homogeneous. The characteristics of a good or service do not vary between suppliers.

- Producers enter and exit the market freely.

- Both buyers and sellers have perfect information about the price, utility, quality, and production methods of products.

- There are no transaction costs. Buyers and sellers do not incur costs in making an exchange of goods in a perfectly competitive market.

- Producers earn zero economic profits in the long run

8. Match List I with List II

| Market | Features |

| 1. Perfect competition | A. Product improvements |

| 2. Monopoly | B. Price rigidity |

| 3. Oligopoly | C. Smaller competitors can’t survive |

| 4. Monopolistic competition | D. All firms are price takers |

Find the correct code.

A. 1-D 2-C 3-B 4-A

B. 1-C 2-D 3-B 4-A

C. 1-D 2-C 3-A 4-B

D. 1-A 2-B 3-C 4-D

Solution

The correct answer is 1-D 2-C 3-B 4-A.

Key Points

- List I(Market Forms)List II(Distinctive featured)a.Perfect competitioni)All firms are price takersb.Monopolyii)Smaller competitors can’t survivec.Monopolistic competitioniii) Product improvementsd. Oligopolyiv)Price rigidity

- Hence, Option 1 is correct.

- Perfect Competition

- All firms sell an identical product (the product is a “commodity” or “homogeneous”).

- All firms are price takers (they cannot influence the market price of their products).

- Market share has no influence on prices.

- Buyers have complete or “perfect” information—in the past, present, and future—about the product being sold and the prices charged by each firm.

- Resources for such labour are perfectly mobile.

- Firms can enter or exit the market without cost.

- Monopoly

- Competitors are not able to enter the market as there are high barriers to entry.

- There is only one seller in the market, meaning the company becomes the same as the industry it serves.

- The company that operates the monopoly decides the price of the product that it will sell without any competition keeping its prices in check. As a result, monopolies can raise prices at will.

- A monopoly often can produce at a lower cost than smaller companies. Monopolies can buy huge quantities of inventory, for example, usually a volume discount. As a result, a monopoly can lower its prices so much that smaller competitors can’t survive.

- Monopolistic Competition

- It occurs when an industry has many firms offering products that are similar but not identical.

- Unlike a monopoly, these firms have little power to set curtail supply or raise prices to increase profits.

- Firms in monopolistic competition typically try to differentiate their products in order to achieve above-market returns.

- Heavy advertising and marketing are common among firms in monopolistic competition and some economists criticize this as wasteful.

- Oligopoly:

- Oligopoly is when a small number of firms collude, either explicitly or tacitly, to restrict output and/or fix prices, in order to achieve above normal market returns.

- Economic, legal, and technological factors can contribute to the formation and maintenance, or dissolution, of oligopolies.

- Government policy can discourage or encourage oligopolistic behaviour, and firms in mixed economies often seek government blessing for ways to limit competition.

9. When two goods are completely interchangeable, they are

A. Perfect substitutes

B. Perfect complements

C. Giffen goods

D. Veblen goods

Solution

The correct answer is Option 1.

Key Points

Perfect substitutes:

- Those good which can be used in place of another good with just the same function is called a perfect substitute for the other good.

- For such goods, if the price of one good increases, the demand for its substitute increases.

- It can be used in exactly the same way as the good or service it replaces.

- It comes into play where the utility of the product or service is pretty much identical.

- They can satisfy the same necessity of consumers in exactly the same way.

Additional Information

- Perfect complements: Goods, which have to be used together to satisfy a want.

- Like bike and fuel.

- Giffen goods: These goods are commonly essentials with few near-dimensional substitutes at the same price levels.

- Demand for Giffen goods rises when the price rises and falls when the price falls.

- E.g: Bread, rice, and wheat.

- Veblen goods:

- They are the goods whose demand increases as the price increases, because of their special nature and appear as a status symbol.

- They are typically high-quality goods.

- They are demanded by prosperous consumers who spend a lot on the utility of the good.

10. Which among the following best describes the situation of oligopoly?

A. when a company and its product offerings dominate a sector or industry

B. when all the firms of an economy collude to fix prices

C. when small number of firms collude to fix prices

D. when market situation is dominated by a single buyer

Solution

The correct answer is option 3, i.e when a small number of firms collude to fix prices.

- Oligopoly is a market structure with a small number of firms, none of which can keep the others from having significant influence.

- Oligopoly is when a small number of firms collude, either explicitly or tacitly, to restrict output and/or fix prices, in order to achieve above normal market returns.

- Economic, legal, and technological factors can contribute to the formation and maintenance, or dissolution, of oligopolies.

- The major difficulty that oligopolies face is the prisoner’s dilemma that each member faces, which encourages each member to cheat.

- Government policy can discourage or encourage oligopolistic behavior, and firms in mixed economies often seek government blessing for ways to limit competition.

- A monopoly refers to when a company and its product offerings dominate a sector or industry.

- There is only one seller in the market, meaning the company becomes the same as the industry it serves.

- A monopsony is a market condition in which there is only one buyer, the monopsonist.

- In a monopsony, a single buyer generally has a controlling advantage that drives its consumption price levels down.

- Thus, the difference between a monopoly and monopsony is primarily in the difference between the controlling entities.

- A single buyer dominates a monopolized market while an individual seller controls a monopolized market.